LHDN Overview of the e-Invoice

To facilitate transition to e-Invoice, taxpayers can select the most suitable mechanism to transmit e-Invoices to IRBM, based on their business requirements and specific situation.

Application Programming Interface (API)- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

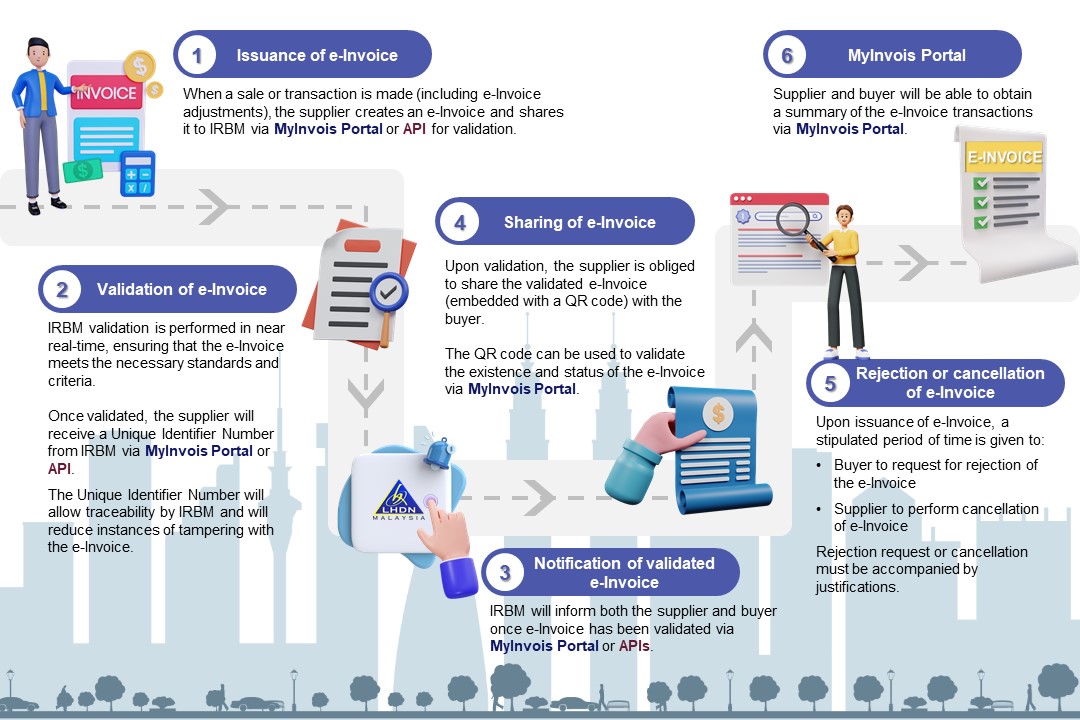

The figure demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing validated e-Invoices on IRBM’s database for taxpayers to view their respective historical e-Invoices.